GeoLegal Weekly #10 - How "cancel TikTok" and the politics of US Steel could cause broader corporate blowback

The US may ban TikTok and block a Japanese company from buying US Steel. This could lead Japan to pull back FDI, China to crack down on US companies, and rule of law to be questioned.

Countries generally love foreign direct investment (FDI) - that is, when a foreign country buys a stake in a firm or project in their territory. FDI can boost domestic companies and create jobs, helping domestic firms challenge competitors and, often, gobble-up know-how from new management.

But what if the benefits of FDI were intended to flow in reverse? To take the UK as an example, what if foreign companies were seeking to buy British companies in order to learn trade secrets or, worse, national security secrets? The UK government wouldn’t like that very much and would try to stop it. Indeed, Dechert notes that there are over 50 investment screening regimes - from the Philippines to Estonia - all designed to address the fact that not all inbound investment is benign.

Perhaps the most well-known of these regimes is the Committee on Foreign Investment in the United States (CFIUS), an inter-agency effort that advises the President whether or not to block mergers or acquisitions in the US on the basis of national security. In 2008, I gave my first presentation on CFIUS to a room full of sovereign wealth funds who were all scared the US would embarrass them, as it did when Dubai Ports World (DPW) was dragged through the political mud for trying to acquire US port operations in the post 9/11 era. While CFIUS didn’t directly block the deal, Congress exerted substantial political pressure that led DPW to hive off the sensitive assets, after significant reputational damage.

Back then, the rules of the game were easier to understand and seemed mainly to be a worry for state actors trying to buy clear national security assets. That is no longer the case. Today, the US CFIUS process can review deals even after they have been completed. Deals in particularly sensitive areas involving data and technology can be reviewed even if a foreign government is not directly involved. The threat of embarrassment often leads firms to abandon deals while CFIUS investigates them. If the President blocks a deal, judicial review is very limited or non-existent (for a more scholarly look at judicial review of one major CFIUS case, read here).

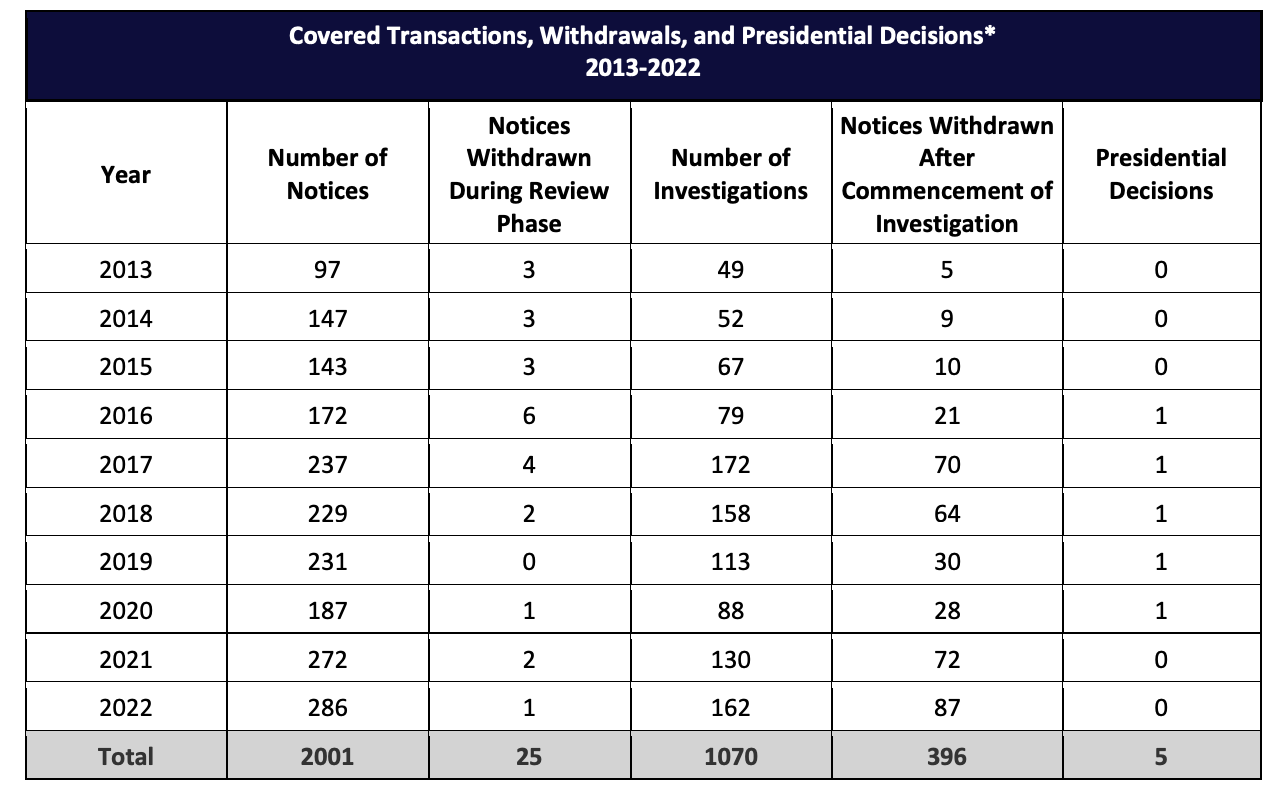

In fact, the sheer volume of deals CFIUS reviews—and of companies pulling out of deals or deals being blocked by the President—has increased dramatically.

TikTok and US Steel

Today, the line between a state controlled actor and a private actor looks different. Bytedance, the parent of social media powerhouse TikTok, is a Cayman Islands incorporated company majority-owned by global investors including some of the biggest US investment funds. But it also has Beijing as its headquarters and a number of relationships throughout the Chinese government.

The collection of Americans’ data by the Chinese government via TikTok is a concern since the Chinese government can compel Chinese companies to turn over data collected. As TikTok has become an influential vehicle for delivering content, including news, to many Americans, the fear is it could become a vehicle for Chinese propaganda even if there are no indications it is doing so today. I’ve written elsewhere about how Uber successfully used its customers to apply political pressure on those trying to ban it. TikTok apparently tried something similar by sending notifications to its users to lobby Congress in its favor, which spooked lawmakers further because it was a sign of influence.

US skittishness about an adversarial power, China, having such a large digital footprint is not surprising. In the past, CFIUS forced the divestment of dating app Grindr from a Chinese company over fears of the collection of information about Americans’ sexual orientation and other sensitive health data. Former US President Donald Trump actually tried to force TikTok to divest its US business but was gummed up on procedural grounds. There are other examples.

The situation with Nippon Steel, who has recently offered a significant share premium for US Steel, is different. Japan is one of America’s closest and longest-standing allies and host to significant US military assets. Japan is also the largest source of foreign direct investment into the United States. Japan frequently submits to CFIUS review and no Japanese deals have been formally blocked. Yet, US President Joe Biden recently called for the deal to be scuttled.

Nippon Steel has come out publicly and assured that there would be no job losses from the acquisition. A number of analysts have noted that Nippon is making the purchase to serve US customers so there is little risk of reducing investment in America.

Yet both of these companies find themselves in the political spotlight.

Welcome to the 2024 Election Season

Friend or foe, no deal is safe in the US for the next nine months. “Why”starts with the presidential race but flows quickly down to Congress.

The easiest way for a candidate to distract from domestic political trouble is to point to a foreign adversary voters can fear (remember the movie Wag the Dog?) But you know how to earn double points? If beating up on the foreign adversary actually benefits US interests who then support you in return.

That’s a bit of what’s happening with both US Steel and TikTok. On the former, Biden’s position that the deal shouldn’t be completed is a sop to US labor interests he needs to support him. It’s not clear that he will actually block the deal, so Trump has tried to one-up him by saying he absolutely would block the deal.

With TikTok, the extra credit is a little less clear but not less valuable. While there’s little love for the major US social media companies on Capitol Hill, they would no doubt benefit if all the ad dollars spent on TikTok suddenly flowed back to their platforms. What better way to quietly court their support than attempt to shut down or shut out one of their biggest competitors?

What’s easy to forget, however, is that every member of the House of Representatives is up for re-election and so is one-third of the Senate. So, they are getting in on the fun as well. The House just passed a bill to force ByteDance to divest TikTok, and it now moves to the Senate, where I suspect it will remain alive long enough for every Senator to score political points on every angle of the story but probably never pass.

That’s because voter enthusiasm matters in this election, which is all about mobilizing those who can vote to do so. Banning a popular social media platform is a great way to turn off younger voters who love the app.

Instead, we’ll probably see the gears turned on TikTok to open itself up to enhanced scrutiny, which will allow everyone to claim they solved the problem. Improving the app doesn’t come with the same political risk as banning it - indeed, younger voters might be happy with a more secure TikTok to the extent they pay attention to the debate. To get a sense of what such safeguards might look like, you can read fascinating example of the types of things demanded by the US government in one CFIUS review involving TikTok, which was leaked recently.

On US Steel, it feels like the type of issue that politicians want to have on the agenda to score domestic points but don’t actually want to block. My best guess is that the deal will quietly be approved in the lame duck period after the US election but there is serious downside risk on either of these deals during election season.

Implications

While its fun to try to predict outcomes, it’s more important to understand the implications of what’s already happening here. There are a few key takeaways:

Tread lightly until December - To the extent your business wants to make a controversial move this year - whether you are a foreign business buying a US asset or a domestic or foreign company of some scale considering significant layoffs - make sure you understand the politics of how it will be received. Politicians may not be able to stop you, but they also make make it thrice as painful for you if electoral politics line up. Gillian Tett has a great piece that unpacks what TikTok tells us about broader political risk in markets, noting “TikTok is thus partly a tale about the investment cost of geopolitical risk. But it is also one about the capricious nature of US domestic policymaking.” For my money, then, its safer to do your dirty work in December: When Congress wants to get out of town and voters have outrage fatigue following the election, policymakers will be too distracted to be capricious.

Backlash to the US in China could ensue - The scrutiny of TikTok will no doubt further stress the business dynamics of US companies operating in China. I will write an entire issue on the topic soon but the reality is that Beijing has been making it increasingly hard for US companies to operate and embarrassment around TikTok would only increase that dynamic.

Japan risk rising - With respect to Japan, however, the implication of such a politically toxic dynamic is new and perhaps more corrosive. Past Japanese ambassador to the US Kenichiro Sasae was quoted recently saying that the politics around US Steel is a “a warning sign to some segments of Japanese investors.” As the top source of FDI into the US, a dry-up of Japanese investment does not bode well for cash-hungry US companies grappling with an increased cost of capital for which Japanese firms and investors could be a solution. If the deal goes through, Japan will chalk it up to politicking during silly season. However, if the US Steel deal gets scuttled, this dynamic will be much exacerbated.

Rule of Law Risk in the US - All of the above raises serious questions about rule of law in the United States, as I highlighted in my top theme for the year Rule of Law Recession. There is the legal and regulatory structure called CFIUS that governs sensitive asset purchases in the US. That structure typically encourages companies to collaborate with the US in order to gain a seal of approval that their deal does not harm national security and in order to mollify any concerns before they become a public issue. However, these deals have jumped from the regulatory apparatus - the CFIUS process - into the political process, which sends a warning sign for companies and countries that seek to avoid scrutiny. The US is not the only place for global investors to invest their money - to the extent they fear embarrassment or expensive delays, they will also look elsewhere.

Transmission Risk is Real - If the US is worried about foreign apps using customer data for nefarious purposes, there’s no reason other countries wouldn’t take the same position with regard to American platforms. Foreign countries could force divestitures of US social media platform assets in their countries if they feel the US has set the precedent for doing so. European countries present a risk in this scenario.

In Other News

VIP Ticket Alert - One of my big goals this year is to bring conversations about the legal world onto non-legal platforms in order to get policymakers and tech leaders to think critically about legal. I’m excited to deliver this via a panel at CogX Los Angeles, the first USA summit of Europe’s top AI and transformational technology conference. I’m moderating an awesome panel of Joshua Browder (CEO of DoNotPay), Natalie Anne Knowlton (Founder of Access to Justice Ventures) and Chris Brown (AGC at Virgin Galactic) to get to the bottom of whether technology will give rise to self-representation or whether lawyers will become even more necessary in the future. If you are a senior executive or tech founder and would like to attend as my guest with a VIP pass in Los Angeles on 7 May, please reply to let me know. (For anyone wondering, yes this overlaps with CLOC CGI - I’ll be at both this year!)

AI Washing in Legal - I wrote an early take on AI washing and regulatory scrutiny back in January. ALM has a nice breakdown this week of some industry insiders chopping it up about what AI washing means in legal.

In praise of Sam Waterston’s Manhattan DA Jack McCoy - More than one person I know has quietly admitted to me that they decided to become a lawyer after watching Law and Order growing up. Others told me they backed Fred Thompson in the 2008 Republican primary because of his turn as DA on the show. If you’ve ever traced your passion for law or politics back to the series, then Esquire’s paen to Sam Waterston is worth 2 minutes of your time.

-SW