GeoLegal Weekly #63: The future of Lobbying / Tariff Dump and Pump

How to Make Friends and Influence POTUS. Also is Trump manipulating the stock market?

Earlier this week, MIT Sloan Business Review carried a piece I co-wrote on the future of lobbying, called "How to Make Friends and Influence POTUS." I was privileged to write it with Brody Mullins, the Pulitzer Prize winning co-author of the seminal Washington lobbying tome, The Wolves of K Street. If you want a copy to read, let me know as I have purchased a limited number of licenses.

This week, Brody and I sat down to discuss the piece and the future of lobbying.

The core argument of our piece is that lobbying is changing in two ways. First, the history of lobbying has been one of decentralization - the rise of Washington committee chairs, the sprouting up of a variety of lobbying shops (known as K Street) and the ability for many industries to make their desires known by fanning out across the Capitol with threats and inducements. Under Trump, there is a severe reversal of this phenomenon: Congress is irrelevant and all lobbying is now done to the executive.

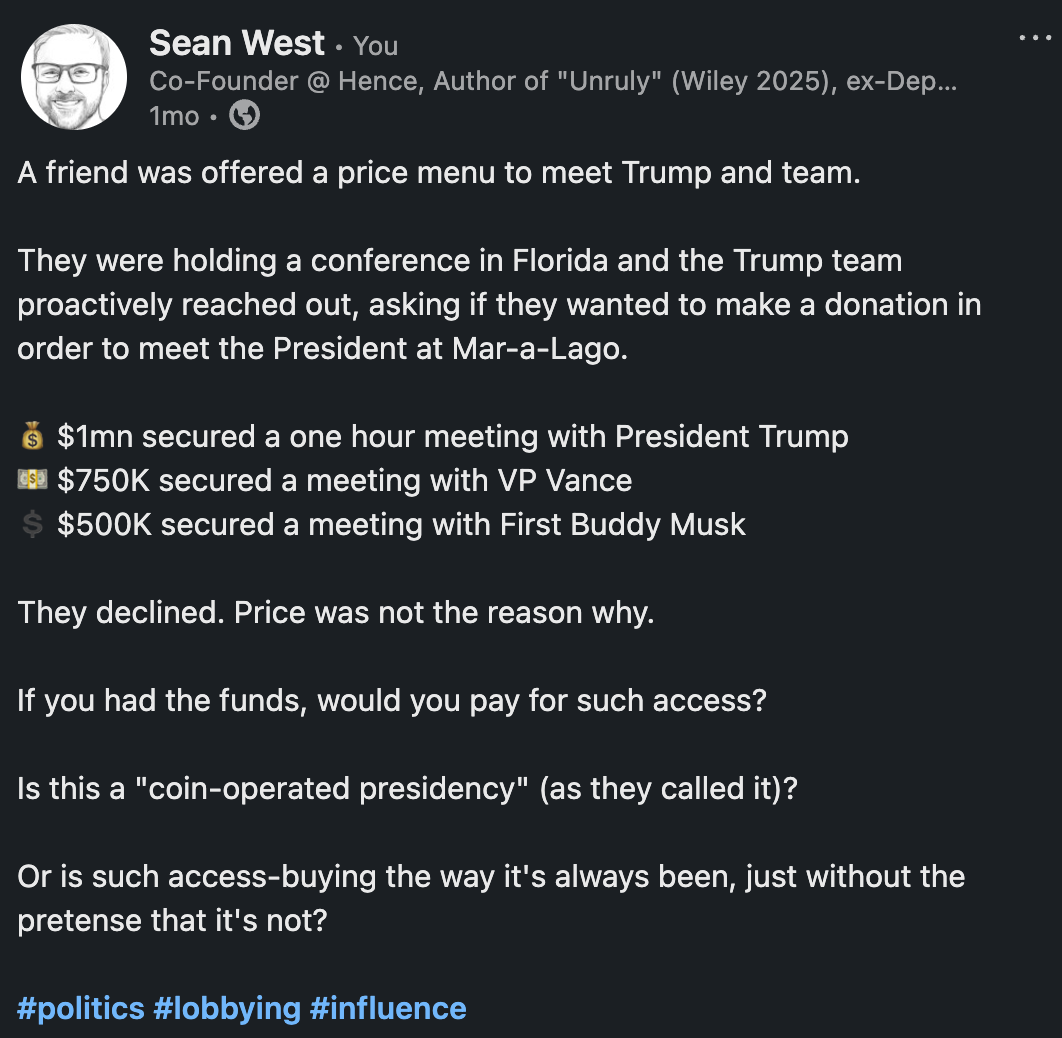

This gives rise to calls for big donations to get access to the president, as I wrote about on LinkedIn below. $1mn for Trump, $750,000 to see VP Vance and $500,000 to see Musk. It also elevates the small number of stakeholders who have access to Trump to try to change his mind.

But there's a second big shift underway which is the automation of lobbying, as I wrote about in GeoLegal Notes #12, where I discussed the topic with Damien Riehl. Rather than rehash that piece, check out the MIT article for a summary of how lobbying robots are being built. These two changes define the lobbying landscape and call for new approaches to influence. Creative ideas like buying advertising time during Trump's favorite televised sporting events (as Brody suggests) may make more sense than paying for the suits of K Street. Tokens and compute that can automate the lobbying stack will further shift the landscape.

Dump and Pump

The political risk industry - where I cut my teeth - occasionally veers into political intelligence for public market investors. What that means is that instead of trading on the insights of the smartest analysts, investors can pressure their hired analysis shops to simply run around collecting facts about what is going to happen next in governments around the world. When those facts are non-public and material to an asset price, they can get caught in insider trading rules, which make most analysts pretty careful to avoid this type of service.

But what happens when government officials trade stocks based on their own knowledge of or ability to influence such debates? There was a big hubbub around the 2008 global financial crisis about this and Brody's coverage of it was distinguishing. Now, after last week’s tariff tornado we have to ask the question: Is Trump manipulating markets to the financial benefit of himself and his friends?

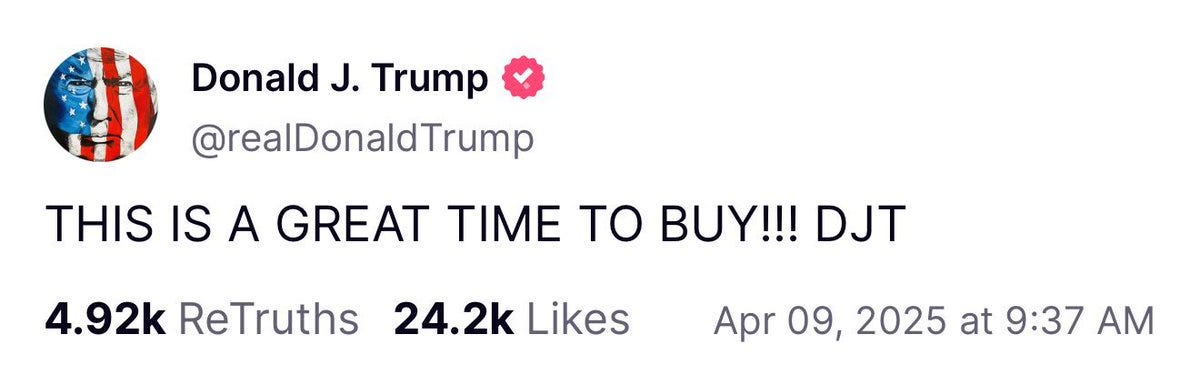

This is not an easy question to answer. But we can look at the following pattern. At the beginning of last week, Trump tanked the markets with global tariff proposals. In the middle of the week, he told followers on Truth Social "THIS IS A GREAT TIME TO BUY!!! DJT".

A few hours later, he paused much of the tariffs leading to a market rally. By the end of the week. It was mostly only China being tariffed and there were exemptions to that as well. He was then shown in the oval office laughing about how much money the investors visiting him had made that day.

Moreover, a Bloomberg investigation showed the Trump family has gained almost $1bn (from crypto investments since he came into the White House seeking to remove regulations on crypto.

Has Trump or anyone near him done anything illegal in this case? The evidence isn’t clear. But the more startling realization is that it almost doesn't matter: The days of prosecuting politicians for profiteering seem long gone. Trump would simply waive off such prosecutions with impunity—so long as they are not his enemies.

-SW